unemployment income tax refund calculator

This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income. This is the latest round of refunds related to the added tax exemption for the first 10200 of.

Do I Need To File A Tax Return Forbes Advisor

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

. In case you have any Tax Questions. Only one payment your check is. In case you got any Tax Questions.

Taking advantage of deductions. Were here for more than calculating your estimated tax refund. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income.

Withholding information can be found through the IRS Publication 15-T. Tax Refund Estimator For 2021 Taxes in 2022. The percentage depends on your income.

Ad Free tax calculator for simple and complex returns. Estimate your tax refund with HR Blocks free income tax calculator. Unemployment income Tax calculator help.

Said it would begin processing the simpler returns first or those eligible for up to 10200 in excluded benefits and then would turn to returns for joint filers and others with more complex returns. Taxable scholarships or fellowship grants and unemployment compensation. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

Filing with us is as easy as using this calculator well do the hard work for you. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Yes No Self-Employment Form 1099-NEC or 1099-MISC.

This Estimator is integrated with a W-4 Form Tax withholding feature. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome.

Estimated Taxes Owed. The first refunds are expected to be issued in May and will continue into the summer. Its never been easier to calculate how much you may.

The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive. People who are married filing jointly can exclude up to 20400 up to 10200 for each spouse who received unemployment compensation. Unemployment pay1099-G retirement pay 1099-R StateLocal Tax Rate.

Calculate your tax refund for free. Contact a Taxpert before during or after you prepare and e-File your Returns. It is mainly intended for residents of the US.

The Franchise Tax Bureau has created a calculator tool that allows you to estimate the size of your payment by answering six questions. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income. The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. This handy online tax refund calculator provides a.

10200 x 2 x 012 2448 When do we receive this unemployment tax. The EIC reduces the amount of taxes owed and may also give a refund. If your company is required to pay into a state unemployment fund you may be eligible for a tax credit.

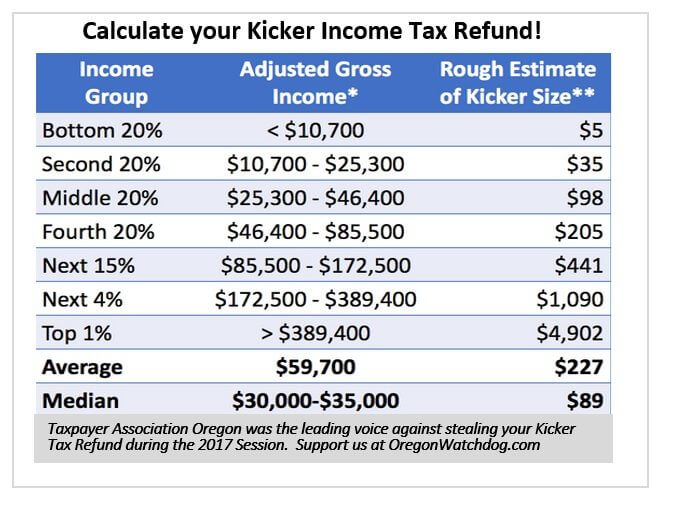

Up to 10 cash back TaxSlayer is here for you. Under the new law taxpayers who earned less than 150000 in modified adjusted gross income can exclude some unemployment compensation from their income. Premium federal filing is 100 free with no upgrades.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. Additional fees apply with Earned Income Credit and you file any other returns such as city or. This means they dont have to pay tax on some of it.

You have now Successfully Completed Your 2021 IRS Income Tax Return Calculation. The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income. The payment for the earned income credit or noncustodial parent earned income credit is 25 of the amount of the credit you received for 2021.

Deduct federal income taxes which can range from 0 to 37. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. There are a variety of other ways you can lower your tax liability such as.

The tax rate is 6 of the first 7000 of taxable income an employee earns annually. If you are expecting a large income tax refund but need to file a Chapter 13 bankruptcy case. And is based on the tax brackets of 2021 and 2022.

The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. Choose TaxSlayer and get your maximum refund and 100 accuracy guaranteed. This Estimator is integrated with a W-4 Form Tax withholding feature.

Ad See How Long It Could Take Your 2021 State Tax Refund. Employee 3 has 37100 in eligible FUTA wages but FUTA applies. Guaranteed maximum tax refund.

WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. IR-2021-71 March 31 2021. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS.

Tax Refunds Tax Refund Tax Services Tax Debt

How Much Income Tax Will I Pay On 55000 Filing Taxes

What To Do If Your Tax Return Is Flagged By The Irs

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

This The Average Tax Refund And How To Make The Most Out It

Bankruptcy During Tax Time Can You Keep Your Refund The Law Offices Of Kenneth P Carp

Vat Registration Accounting Tax Consulting Tax

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Tax Refund Estimator Factory Sale 55 Off Www Wtashows Com

What Are Marriage Penalties And Bonuses Tax Policy Center

Here S How To Get A Bigger Or Smaller Tax Refund Next Year

This Online Calculator Will Show You How Much To Expect Iheartradio Tax Deductions Successful Home Business Finances Money

Irs Releases Draft Form 1040 Here S What S New For 2020 Irs Forms Tax Return Income Tax Return

Tax Return Calc Clearance 57 Off Www Wtashows Com

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

How To Estimate Your Tax Refund Lovetoknow

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor